Revolution.Aero Uplift: The rise and fall of Aerion

exc-60ae242d4deab64a54bc7d69

It all began in 2004, when Texan billionaire Robert Bass decided to re-commercialise supersonic aerial travel by launching Aerion Supersonic. By 2021, it had a backlog of $11.2bn – or 93 orders – for its AS2 supersonic jet. And soon after announcing the near-hypersonic AS3, a new concept, the company ground to a halt, shutting down unexpectedly last weekend.

At $120m each, the Mach 1.4 AS2 promised to connect any two points on Earth “in three hours or less” by 2027. Industry veteran Dr Richard Tracy spearheaded the vision for supersonic business travel, alongside ex-Gulfstream and Rolls-Royce engineer, Michael Hinderberger and others.

Big names such as Lockheed Martin, Airbus, Boeing and GE Aviation all worked – not at the same time – with Aerion to develop the AS2. In addition to engineering, manufacturing and flight-testing services, Boeing also invested in the company.

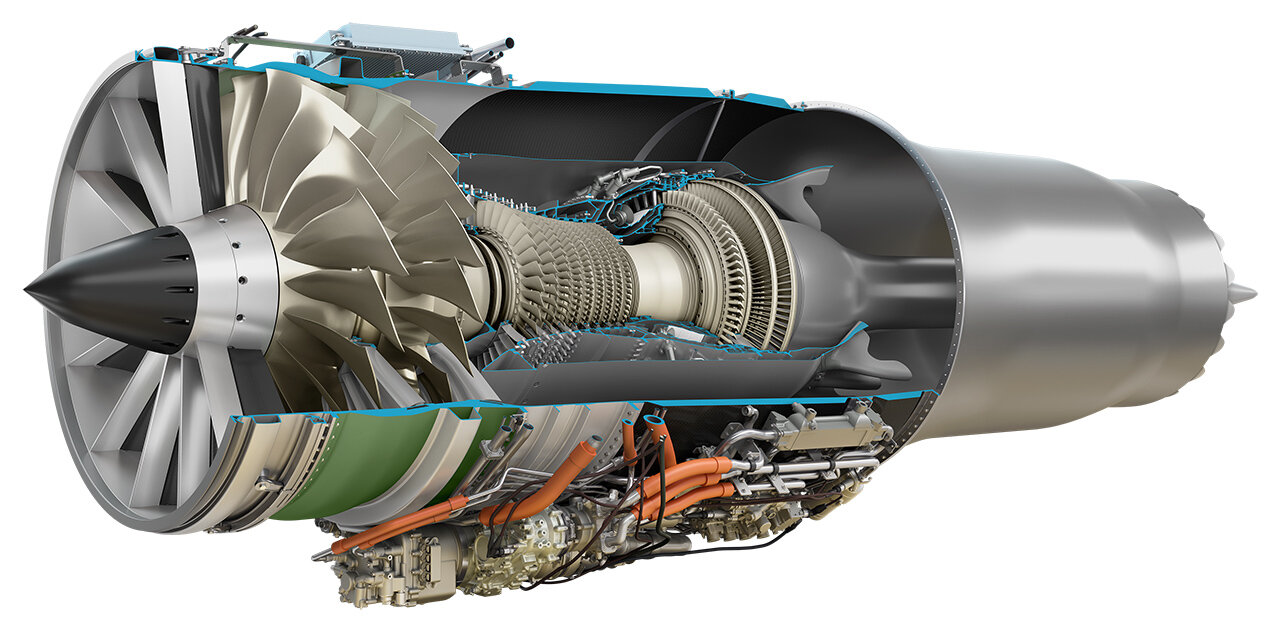

GE has also said it is no longer building the twin-shaft, medium-bypass Affinity engine which would have powered the AS2.

In March this year, NetJets ordered 20 AS2 jets worth $120m each. It also signed an exploratory agreement to become the exclusive business jet partner for Aerion Connect, a platform to provide seamless point-to-point services.

The company was reported to be in talks to go public via a SPAC (Special Purpose Acquisition Company) merger earlier this year, but this did not come to fruition.

Ex-board member Bryan Moss, vice chairman, Moss Consultants, told Revolution.Aero: “I am very impressed by what they achieved in such a short time and I am disappointed with what has happened.”

What went wrong?

There were rumblings about the costs to set up Aerion’s new headquarters in Melbourne, Florida being too high. However, the company’s announcement came as a shock to many – including some partners. Many believe it was a combination of factors.

Aerion told Revolution.Aero, it had “proven hugely challenging to close on the scheduled and necessary large new capital requirements to finalise the transition of the AS2 into production”.

Industry insiders agree that it is a very difficult time to raise private investment in public equity (PIPE). One source said: “This is based upon the movement away from emerging technologies, which has partly caused the reopen in trade. And second, there is an inflation concern and rise in interest rates because the world is reopening.”

Companies will tend to show a larger total addressable market when the markets are good. But the AS2 project was extremely capital intensive. “The market for a supersonic business jet is just not that large, on a per unit basis, to support the R&D and production cost,” a source said.

According to Richard Aboulafia, vice president, Analysis at Teal Group, Aerion’s funding to develop the GE Affinity engine “greatly increased their non-recurring bill, which probably helped kill” the start-up.

Nick Fazioli, Jefferies MD Aerospace and Aviation told our Town Hall earlier this month the summer and autumn would prove a critical time for the first aviation industry SPACs. “This summer and fall [autumn] is going to be a really interesting time because we are going to see how these early deals that we keep referring to are going to play out through their shareholder growth and trading, free from the SPAC safety net. It will be telling to see how this plays out.”

Experts believe SPACs are making a major contribution to innovation in the US – filling the space occupied by sovereign wealth funds in other countries.

According to Richard Aboulafia, vice president , Analysis at Teal Group, Aerion’s funding to develop the GE Affinity engine “greatly increased their non-recurring bill, which probably helped kill” the start-up.

Boomless cruise technology and future

Aerion’s technology is another factor which might have caused it to receive inadequate funding. Its patented boomless cruise suggested flight without sonic boom. But this would have required frequent altitude changes, which some thought would make it challenging to operate on a schedule. “A low boom aircraft would probably be a better way to go,” said one source.

Some of Aerion’s early-stage competitors, such as Spike, offer this option. While Boom Supersonic, another competitor is aiming to offer the service to commercial airline passengers – therefore opening it up to a much greater market.

JetNet iQ founder Rolland Vincent still thinks “the market is clearly there” for a supersonic airplane. “Pricing has been established. The technology does not require any leaps of faith. Capital is cheap and [he thought] generally available,” said Vincent.

Boom Supersonic’s Overture is aiming to offer the supersonic service to commercial airline passengers.

Aerion could turn to investors to raise capital, however Boeing, a big investor, was understandably hit hard by the pandemic. An industry insider told Revolution.Aero that Aerion might have a chance selling what’s left of its business to one of the “primes” or a company in adjacent markets.

The company’s leadership, characterised by some as “operational” rather than “evangelical” – or passion-based – has been questioned. Although other industry leaders like Moss and Kenn Ricci, principal of Directional Aviation and chairman of Flexjet, which placed AS2 orders in 2015, disagree.

Ricci told Revolution.Aero: “We were particularly impressed with the recent design changes and innovations generated by Tom Vice and his current team. We understand the vast investment required by such programmes to bring them to fruition and the inherent risks involved.”

Whether or not the company is sold, Aerion said its “business jet programme meets all market, technical, regulatory and sustainability requirements”.

Aerion said: “Our team has created disruptive new innovations plus leading-edge technologies and intellectual property … Given these conditions the Aerion Corporation is now taking the appropriate steps in consideration of this ongoing financial environment.”

And so, about 18 years on from its inception, the Aerion project bids farewell.