Ordering the future: ‘This is the most exciting time in aviation for almost a century’

exc-60cc83d374264b4f47e1a69a

Vertical Aerospace CEO Stephen Fitzpatrick positively fizzes with enthusiasm about the future of advanced air mobility (AAM). “This is the most exciting time in aviation for almost a century; electrification will transform flying in the 21st century in the same way the jet engine did 70 years ago,” Fitzpatrick told an investor call last week.

It’s not hard to understand his passion. Vertical recently attracted an order for nearly $4bn, representing 1,000 Vertical Aerospace eVTOLs, from Dublin-based lessor Avolon, Virgin Atlantic and American Airlines.

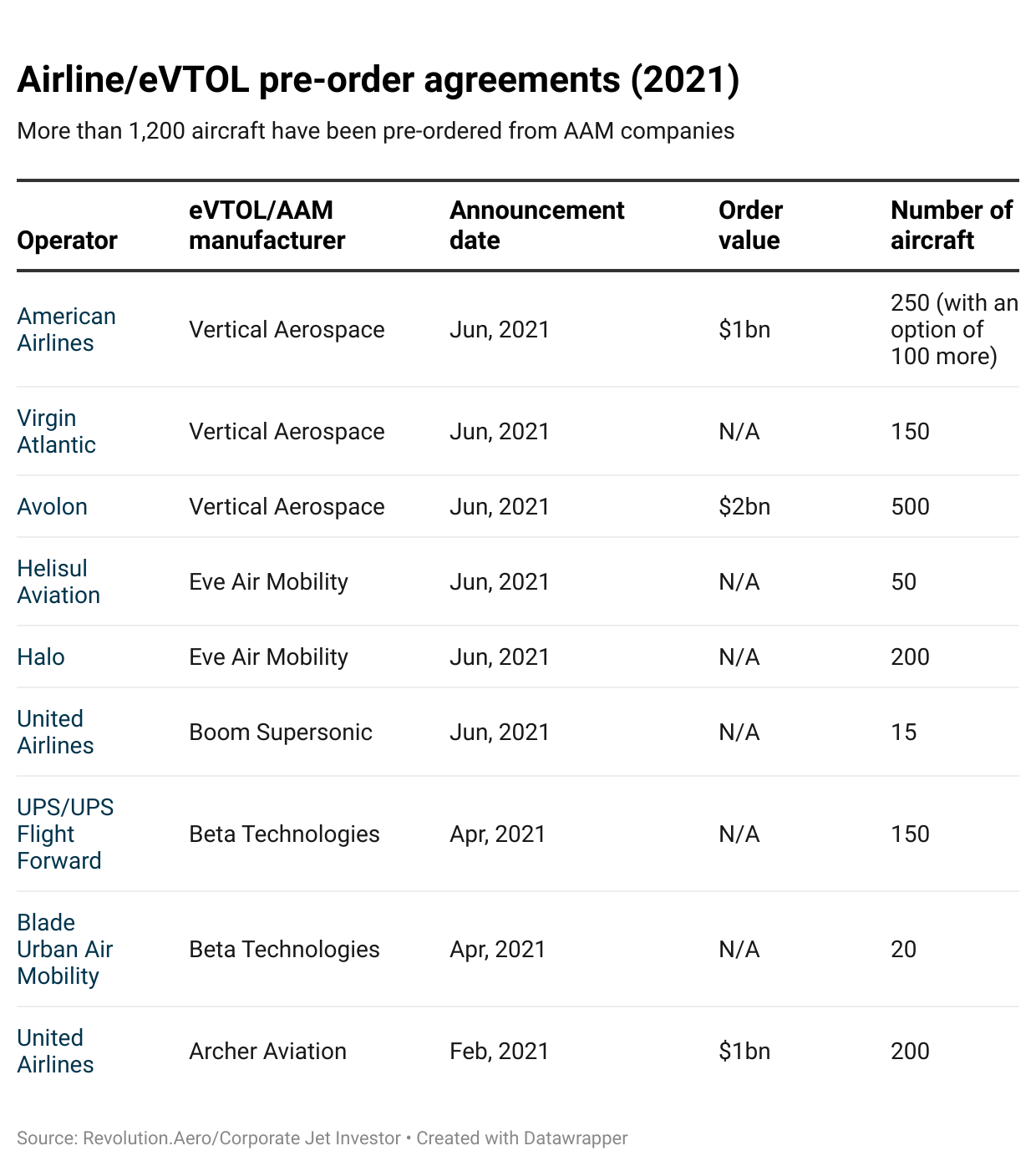

This year itself, more than 1,200 aircraft have been pre-ordered from AAM companies (see our exclusive table). But orders alone do not guarantee success. Even more important than orders in the long run are people, intellectual property and a sustainable business model, Richard Aboulafia, vice president of analysis, Teal Group tells Revolution.Aero.

American has pre-ordered 250 aircraft – worth $1bn – with an option for an additional 100 Vertical VA-X4s. It will also invest $25m through a private investment in public equity (PIPE) transaction – part of Vertical’s Special Purpose Acquisition Company (SPAC) merger. Virgin has a pre-order option for up to 150, while Avolon agreed on up to 500.

It is not enough to receive pre-order interest worth billions of investment dollars. Aircraft orders are completed when the aircraft is produced, certificated and delivered.

Aboulafia says aviation history is full of examples of the best solution losing because an inferior one gets there first. “Like the McDonnell Douglas DC-10 vs the Lockheed L1011 Tristar,” he said.

Avolon CEO Dómhnal Slattery said: “In Vertical, we have identified a long-term strategic operator that shares our vision for a cleaner and more efficient mode of air transport.”

Virgin Atlantic told Revolution.Aero it would “explore short-haul zero emission transfers between our UK hub airports and regional locations that are most convenient for our customers.” Airport connections to and from Oxford (22 minutes), Gatwick Airport (16 minutes) and Battersea (11 minutes, home of the London Heliport) are feasible options.

In addition to the orders, Vertical will go public via merger with Broadstone Acquisition Corp valued at $2.2bn. It will also receive PIPE investment from Honeywell Aerospace and Rolls-Royce – which will provide electric propulsion technology – Fitzpatrick said on the investor call last week. Other aerospace partners and investors include Microsoft, GKN and chemical company Solvay.

“Combining their expertise with our own world-class engineering team means we have the fastest and lowest risk path to certification, creating a lean, asset-lite business model with highly attractive unit economics,” said Fitzpatrick.

Aboulafia said there are parallels to be drawn from the surge in pre-orders. Particularly with companies such as Aerion, Eclipse – which aimed to pioneer the very light jet (VLJ) revolution – and other aircraft OEMs.

Once backed by Airbus and Boeing, Aerion Corporation recently folded due to a lack of funds. The supersonic start-up had a total backlog of $11.2bn from customers including NetJets and Flexjet. Still its AS2 business jet could not be built and delivered.

Eclipse too claimed it had a backlog of 2,600 jets in 2007. Of this number, only 280 VLJs were delivered due to a series of bankruptcies and changes in major shareholders. Of the 15-20 companies attempting to make very light jets at the time, the Embraer Phenom 100 is the only one of note today, adds Aboulafia.

Two decades later, Eclipse has now been bought by British entrepreneur Christopher Harborne.

Textron Aviation’s $1.6bn backlog, from 2018, is one of the most significant changes in aviation history. This was a long way from a $14.5bn backlog in the first quarter of 2008.

Supersonic bizjet start-up Aerion had a total backlog of $11.2bn from customers including NetJets and Flexjet

Production, certification and delivery

But Vertical and partners do have a plan to achieve production, certification and delivery. A full-scale prototype of the VA-X4 is in production and the first test flight is planned for later this year. Fitzpatrick said its strengths lie in choosing piloted operations, experienced engineers and robust industry partnerships.

Vertical is also aware that certification is the most difficult hurdle for eVTOL makers. He added: “We therefore operate with an expectation that regulatory authorities will be risk averse and will not succumb to pressure to adopt new and unproven technology. The end result for Vertical is the creation of a business model that is built around the assumption that we have to play by the current rules, within the existing regulations, and based off technology that exists today.”

Chief financial officer Vinny Casey said Vertical’s business was built on a bottom-up basis – estimating a company’s future performance by starting with low-level company data and working up to revenue.

It is drawing on the experience of “Rolls-Royce and Honeywell which will design and develop key components where existing technologies exist and can be leveraged,” said Casey. Operating costs are projected at “just over one hundred dollars per aircraft”.

Vertical plans to spend $300m to build and certify the VA-X4. Commercial operations are planned for 2024.

Vertical plans to spend $300m to build and certify the VA-X4 – of which it has $50m – and another $140m to build a facility. The company projects that it would be able to achieve profitability and cash flow breakeven with annual sales of less than 100 aircraft.

“Emerging technologies are critical in the race to reduce carbon emissions and we are excited to partner with Vertical to develop the next generation of electric aircraft,” said Derek Kerr, chief financial officer at American.

Commercial operations of the VA-X4 are planned for 2024 following European Union Aviation Safety Agency (EASA) and UK Civil Aviation Authority (CAA) certification.

Aboulafia and other industry insiders say pre-orders are a great way for airlines to “get a lot of press attention for very little to possibly no money”, as well as to show investors a strategy to attract customers. And secondly, they “don’t want to be last and I better get in line just in case it turns out the store opens up,” added Aboulafia.

In 2020, over 2bn people purchased goods or services online. These orders would have been received, produced, checked for quality and then delivered to your doorstep – which is when the order is completed. The same is true for aircraft orders that run into the billions of dollars.