Revolution.Aero Uplift: SPACs – ‘It pays to know the runners and riders’

exc-609d102a08abed424b99af08

“It’s a horse race but it’s going to be exciting and fun.” The comment from Kirsten Bartok Touw, AirFinance, founder and managing partner, captured the potential of Special Purpose Acquisition Companies (SPACs) to accelerate progress in the field of air mobility. But with up to 500 SPACs in the sector, due diligence pays before making your investments.

Bartok was speaking at last week’s Revolution.Aero Town Hall online meeting, dedicated to SPACs or blank check companies. It’s an area in which Bartok has both form and expertise. In February 2021, Bartok co-founded New Vista Acquisition Corp, a new SPAC launched to raise $200m in an initial public offering. The company is searching for a target business operating in the aviation, aerospace and defence industries.

SPACs offer investors a second chance, according to Robin Riedel, partner with McKinsey & Company. “We’ve seen a number of institutional investors feeling that they missed out on the early tech companies like Tesla and others,” Riedel told the Town Hall delegates. “As a result, they have increased their allocation [of funding] to that asset class, looking for high growth and more future revenue. That has created demand for vehicles to invest in. SPACs offer them a way of investing in an asset class that is more streamlined [than a venture round]. I think that’s one of the drivers.”

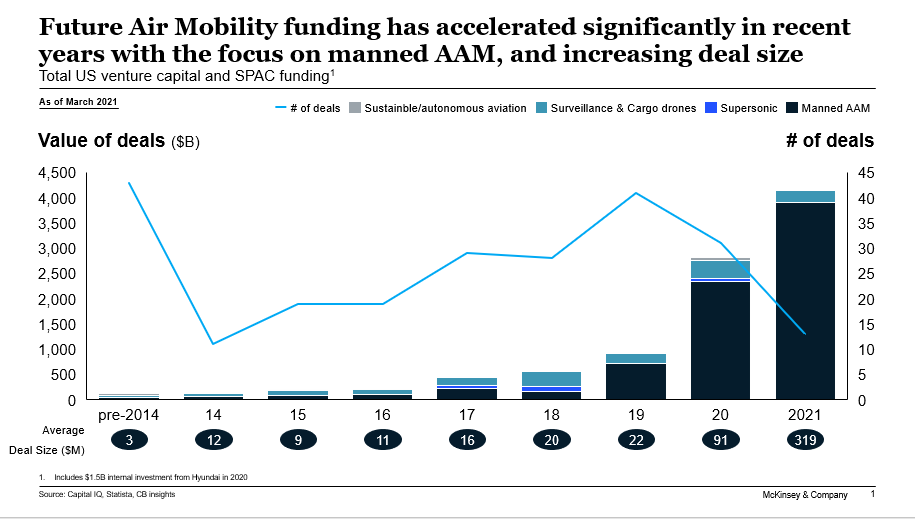

It has proved a popular investment vehicle. Over the past 10 years or so, the future of air mobility – including eVTOL, drones, sustainable aviation and supersonic and hypersonic aircraft – has attracted $8bn of investment, said Riedel. Of that total, 80% has been directed at the manned advanced air mobility (AMM) space. “There’s been a revolution in the funding in the past 18 months, where we have seen a massive increase in funding for manned AAM, including eVTOL and urban air mobility [UAM],”

Nor does that popularity show any sign of flagging. For example, on February 1st, 2021, private jet charter company Wheels Up revealed plans to go public via a merger with blank check company Aspirational Consumer Lifestyle. This deal gave Wheels Up an enterprise value of $2.1bn and $750m in cash.

Bartok believes SPACs are making a major contribution to innovation in the US – filling the space occupied by sovereign wealth funds in other countries. “Having this SPAC structure come out, lean forward and become risk tolerant has really filled that gap in terms of what we have in the US,” Bartok told delegates.

Over the past 10 years, 80% of the $8bn of investment in the future of air mobility – including eVTOL, drones, sustainable aviation and supersonic and hypersonic aircraft – has been directed at the manned advanced air mobility (AMM) space. Courtesy: McKinsey & Company

Another trend was that private investment in public equity (PIPE) investments had become more difficult to find. “One thing is that people have gone back to work,” she said. “The day-traders who were around using their stimulus money have stopped.” Another factor was the steepening yield curve, which prompted investors to pull away from technology investments and turn towards more cyclical and traditional investments.

SPACs have the potential to “supercharge” technological progress, agreed Matt Oresman, partner with Pillsbury Winthrop Shaw Pittman. “One of the positive impacts the SPAC market has had is in catalysing the adoption of new technology and the future,” he said. Confidence in the investment vehicle was demonstrated by US president Joe Biden’s technology plans to mitigate climate change and limit greenhouse gas emissions with help of SPAC funding. “The capital for unlocking that all sits with the SPACs. These are the sources of capital that are going to supercharge technological development at a company level.”

Nick Fazioli, Jefferies MD Aerospace and Aviation, believed SPACs owed their popularity to a combination of factors. “It’s a culmination of technical factors in the market, like interest rates and investment alternatives and Covid-19 have happened to marry up,” he said. “In our industry and others, the advancements in next generation technology are a heck of a lot closer because of advancements in underlying technology and needs.”

Fazioli hoped that SPACs would continue to attract investment funding for small companies with big air mobility plans. “While the SPAC market seems to have slowed down a bit to digest the recent historic level of activity, there are a lot more innovative and interesting companies, even within our own sector, that can certainly benefit from this and I hope it holds on.”

This summer and autumn would prove a critical time for the first aviation industry SPACs, he added. “This summer and fall [autumn] is going to be a really interesting time because we are going to see how these early deals that we keep referring to are going to play out through their shareholder growth and trading, free from the SPAC safety net. It will be telling to see how this plays out.”

One of the attractions of SPACs to investors is that they can reclaim their investment plus interest up to two years after its launch. Once a business becomes a public company, with public board members and is listed and tradeable, the company typically has 24 months to find an investment target, said Bartok. The next stage is known as a ‘de-SPAC’, which is essentially a merger acquisition.

But to unlock that powerful potential, SPACs need industry professionals who can help source a deal and do significant due diligence on the transition and how to structure it, said Bartok. You also need significant company operating expertise, which can nurture the company and help it grow from a private company to a public company. “The more successful platforms, the serial SPACs, have a combination of these types of people,” said Bartok. “We have noticed that more private equity firms have gotten into this and people are doing deeper due diligence and delivering a more additive value role.”

Due diligence was critical. “Dig deep, deep, deep,” advised Bartok. “Those companies that are flying true aircraft and have transitioned to vertical flight are the only ones that are anywhere near close in the short term. Have they transitioned to vertical flight? When will they get there? When will they get their compliance basis accepted? These are the questions you all need to ask.”

So, while investing in air mobility will, like horse racing, retain an element of risk, effective due diligence can significantly lengthen the odds in the investor’s favour.

The Revolution.Aero Town Hall online meeting – titled The SPAC Revolution – took place on Tuesday, May 4th. You can watch the meeting here or listen to the podcast here.

Meanwhile, our Revolution.Aero Global 2021 virtual conference takes place between June 29th and July 1st.